7 Essential Tips for Insuring a Tiny Home That Protect Your Freedom

Discover 7 crucial tips for insuring your tiny home! Learn about specialized coverage options, legal classifications, safety requirements, and finding the right insurance provider for your unique lifestyle.

Why it matters: Tiny homes are revolutionizing housing but traditional insurance doesn’t always cover these unique dwellings – leaving you potentially exposed to massive financial losses.

The big picture: You’ll face distinct challenges when insuring your tiny home since most standard homeowner’s policies exclude mobile or unconventional structures, and RV insurance often falls short for permanent living situations.

What’s next: Understanding these seven essential insurance strategies will protect your investment and give you peace of mind whether you’re parked in a backyard tiny home village or traveling cross-country.

Disclosure: As an Amazon Associate, this site earns from qualifying purchases. Thank you!

Understand the Classification of Your Tiny Home

Your tiny home’s legal classification determines everything about your insurance options. Insurance companies categorize these structures very differently based on construction methods and mobility features.

Mobile vs. Permanent Foundation Structures

Mobile tiny homes on wheels qualify as recreational vehicles under most insurance policies. You’ll need specialized RV coverage that protects during transport and while parked.

Permanent foundation structures get treated like traditional homes by insurers. These require standard homeowner’s policies, but coverage availability depends heavily on local building code compliance and lot ownership status.

RV Certification vs. Traditional Home Building Codes

RV certification through RVIA (Recreational Vehicle Industry Association) opens access to affordable RV insurance policies. However, you’ll sacrifice some interior design flexibility to meet road safety standards.

Traditional building codes allow custom layouts and permanent utilities but require costly structural engineering. Most insurers demand professional inspections and certificates of occupancy before offering coverage.

Impact on Insurance Coverage Options

Your classification choice dramatically affects premium costs and coverage limits. RV policies typically cost $300-800 annually but cap personal property coverage at $10,000-15,000.

Traditional home insurance runs $800-2,000 yearly but provides comprehensive dwelling and liability protection. The key difference: RV policies won’t cover you if local zoning laws change and force relocation.

Research Specialized Tiny Home Insurance Providers

Finding the right insurance for your tiny home requires stepping outside traditional channels. Most standard insurance companies don’t understand the unique nature of tiny homes, leading to coverage gaps or outright rejections.

Traditional Homeowners Insurance Limitations

Standard homeowners policies weren’t designed for structures under 400 square feet or homes on wheels. Most insurers classify tiny homes as “non-standard dwellings,” which often means automatic denial of coverage.

You’ll face challenges with mobile tiny homes since they don’t meet permanent foundation requirements. Even stationary tiny homes struggle with coverage because many insurers require minimum square footage thresholds that tiny homes can’t meet.

Companies Offering Tiny Home-Specific Policies

Strategic Insurance and National General lead the specialized tiny home insurance market. These companies understand the unique construction methods and living situations that traditional insurers reject.

Foremost Insurance Group offers policies specifically designed for alternative living structures. They provide coverage for both mobile and stationary tiny homes, with options for personal property and liability protection that reflect tiny home lifestyles.

RV Insurance for Mobile Tiny Homes

RV insurance becomes your best option if your tiny home is RVIA-certified and remains mobile. Companies like Progressive and Good Sam offer comprehensive RV policies that cover collision, liability, and personal property.

You’ll need to maintain the RV classification by moving your home periodically and keeping it road-ready. This insurance typically costs 50-70% less than specialized tiny home policies but limits your coverage for permanent installations like decks or utility connections.

Document Your Tiny Home’s Value and Construction Details

Thorough documentation protects you during the claims process and ensures you’ll receive fair compensation. Insurance companies need detailed records to understand your tiny home’s true value and unique construction methods.

Professional Appraisal Requirements

You’ll need a certified appraisal from someone familiar with tiny home construction. Standard home appraisers often undervalue tiny homes because they don’t understand the specialized materials and space-efficient design elements.

Look for appraisers who’ve worked with alternative housing or RVs. They’ll properly assess your home’s value based on cost per square foot, materials quality, and custom features rather than comparing it to traditional homes.

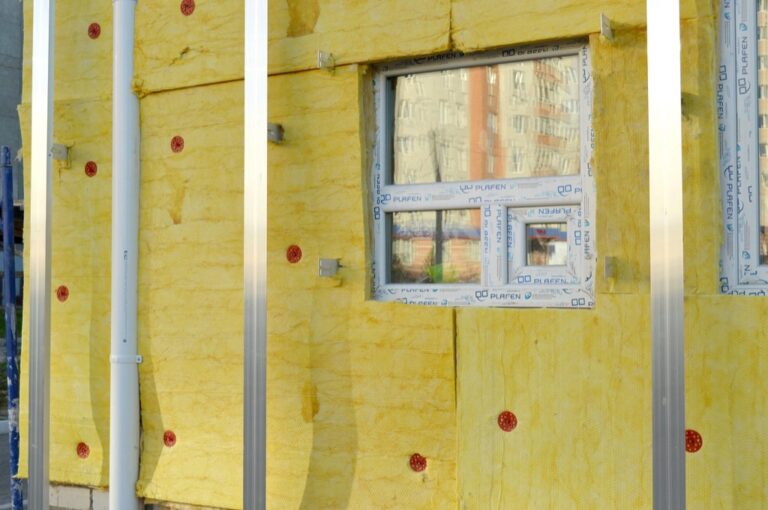

Construction Materials and Quality Documentation

Document every material used in your build with receipts, photos, and specifications. High-end materials like cedar siding, bamboo flooring, or energy-efficient windows significantly increase your home’s replacement value.

Use these 18" cedar shingles for double-coursed sidewalls and decorative projects. Each carton covers 100 sq ft at 14" exposure or 50 sq ft at 7" exposure.

Create a materials inventory that includes brand names, model numbers, and purchase dates. Insurance adjusters need this information to calculate accurate replacement costs, especially for specialized tiny home components that cost more than standard building materials.

Custom Features and Upgrades Inventory

Catalog every custom feature with detailed photos and cost documentation. Built-in storage solutions, fold-down tables, and space-saving appliances represent significant value that standard policies might overlook.

This heavy-duty folding workbench saves space and provides a sturdy work surface, holding up to 550 lbs. Constructed with durable, powder-coated steel brackets and a natural pine wood top, it's perfect for garages, workshops, or home offices.

Keep records of electrical systems, plumbing configurations, and any smart home technology you’ve installed. These upgrades often cost more in tiny homes due to space constraints and specialized installation requirements, making proper documentation crucial for full coverage.

Ensure Compliance With Local Building Codes and Regulations

Building code compliance isn’t just about following rules—it’s your gateway to legitimate insurance coverage. Most insurers won’t touch a tiny home that doesn’t meet local standards, leaving you financially exposed.

Zoning Law Requirements

Check residential zoning classifications before you build or park. Many municipalities restrict tiny homes to specific zones or require them to be classified as accessory dwelling units (ADUs). You’ll need proper permits and must meet minimum square footage requirements that vary by location.

Call your local planning department directly—online information is often outdated. Some areas allow tiny homes in RV parks or designated tiny home communities, while others prohibit them entirely in residential zones.

Safety and Electrical Code Standards

Meet IRC or IBC standards for permanent installations. Your electrical system must pass inspection with proper GFCI outlets, adequate amperage, and professional installation. Plumbing requires permits and inspections for both water supply and waste systems.

Ensure electrical safety with this 15 Amp GFCI outlet. It features an LED indicator for power status and includes a wallplate for easy installation.

Fire safety codes mandate proper egress windows and smoke detectors. Many jurisdictions require at least one exit door plus an emergency escape route. These aren’t suggestions—they’re insurance prerequisites.

This complete egress window well kit provides a safe basement exit. It features a durable steel window well with easy installation, a 500lb capacity UV-resistant polycarbonate cover, and a convenient egress ladder.

Impact on Insurance Eligibility

Code violations automatically disqualify most insurance applications. Insurers verify permits and inspections before issuing policies, especially for permanent foundation homes. Without proper documentation, you’ll face coverage denials or significantly higher premiums.

RVIA certification for mobile units serves as code compliance proof. For site-built homes, you’ll need certificate of occupancy and all inspection records. Keep these documents current—insurers review them during claims processing.

Consider Your Tiny Home’s Location and Mobility Needs

Your tiny home’s placement strategy directly impacts which insurance options you’ll qualify for and how much you’ll pay. Location and mobility decisions affect everything from coverage types to premium costs.

Permanent vs. Temporary Placement Coverage

Permanent placement typically qualifies for homeowner’s insurance if your tiny home sits on a foundation or permanent connection to utilities. You’ll need to prove zoning compliance and permanent utility hookups to most insurers.

Temporary placement requires RV or specialized mobile coverage, even if you stay in one spot for years. Most insurers won’t extend homeowner’s policies to structures that can be moved, regardless of your actual mobility plans.

Multi-State Coverage for Mobile Units

Mobile tiny homes need insurance that covers travel between states, as standard RV policies may exclude certain regions or have limited coverage periods. Progressive and Good Sam offer nationwide coverage with consistent protection levels.

State-specific requirements vary significantly – some states require additional liability coverage or specific certifications. You’ll want a policy that automatically adjusts to meet minimum requirements as you cross state lines.

Natural Disaster Risk Assessment

Geographic risk factors heavily influence your premiums and coverage options. Coastal areas increase hurricane and flood risk, while western regions face wildfire exposure that many insurers now exclude from standard policies.

Mobile advantage means you can potentially evacuate before disasters strike, which some insurers recognize with lower premiums. However, you’ll still need coverage for situations where evacuation isn’t possible or practical.

Evaluate Coverage Options and Policy Limits Carefully

Your tiny home’s unique characteristics demand specific coverage levels that traditional insurance calculators can’t properly assess. Understanding these coverage details before purchasing protects you from costly gaps that could devastate your finances.

This compact Casio calculator features an extra-large 8-digit display and is solar-powered with a battery backup for reliable use. Simplify calculations with convenient tax and currency conversion functions.

Personal Property Protection Levels

Standard RV policies typically offer $5,000-$10,000 in personal property coverage – barely enough for basic belongings in a tiny home. Most tiny home owners need $20,000-$40,000 in coverage to protect their condensed but valuable possessions.

Consider upgrading to replacement cost coverage rather than actual cash value. Your space-saving appliances and custom storage solutions often cost significantly more than standard household items.

Liability Coverage Requirements

Minimum liability limits of $100,000 won’t adequately protect tiny home owners from today’s lawsuit settlements. Aim for $300,000-$500,000 in liability coverage, especially if you host guests or operate a business from your home.

Mobile tiny homes need additional liability protection while traveling. Your policy should cover incidents both at your parking location and during transport between sites.

Additional Living Expenses Coverage

Most policies offer 10-20% of your dwelling coverage for temporary housing – typically $10,000-$20,000. This amount covers only 2-3 months in a standard rental, leaving you financially exposed during lengthy repairs.

Request coverage equal to 40-50% of your dwelling limit. Tiny home repairs often take 3-6 months due to specialized materials and limited qualified contractors in your area.

Maintain Proper Safety Features and Documentation

Safety features directly impact your insurance premiums and coverage eligibility. Insurers require specific safety documentation before they’ll even consider issuing a policy for your tiny home.

Smoke and Carbon Monoxide Detectors

Protect your family from carbon monoxide with this plug-in detector featuring battery backup for power outages. Easily test and silence the alarm with the Test-Hush button, and rely on its 10-year limited warranty.

Install hardwired smoke and carbon monoxide detectors in every tiny home, regardless of size or fuel source. Most insurers require at least one smoke detector per 400 square feet and carbon monoxide detectors within 15 feet of sleeping areas.

Battery-only units won’t satisfy insurance requirements for permanent installations. Propane appliances and wood stoves create additional carbon monoxide risks that insurers scrutinize carefully. Document installation dates and keep annual testing records—insurers often request this proof during policy renewals.

Fire Suppression Systems

Fire extinguishers rated for Class A, B, and C fires are mandatory for tiny home insurance coverage. Mount at least one 2.5-pound ABC extinguisher within 10 feet of your cooking area and another near your electrical panel.

Consider adding a residential sprinkler system if you’re planning permanent placement. While expensive upfront, sprinkler systems can reduce premiums by 15-20% annually. Some insurers require fire suppression systems for tiny homes over 200 square feet, especially those with loft sleeping areas where escape routes are limited.

Regular Safety Inspections and Certifications

Schedule annual safety inspections for all major systems—electrical, plumbing, propane, and structural components. Keep certificates from licensed professionals, as insurers require current documentation for policy renewals.

RVIA-certified tiny homes need annual inspections to maintain their certification status. Non-certified homes should still get yearly electrical and gas system checks from qualified technicians. Missing or expired safety certifications can void your coverage entirely, leaving you financially exposed during claims.

Conclusion

Securing proper insurance for your tiny home doesn’t have to be overwhelming when you’re armed with the right knowledge. By understanding your home’s classification working with specialized providers and maintaining proper documentation you’ll protect your investment effectively.

Remember that tiny home insurance isn’t one-size-fits-all. Your coverage needs depend on whether you’re mobile or stationary your location and your specific lifestyle choices. Take time to compare options from companies that truly understand tiny living.

Don’t let inadequate coverage put your dream home at risk. Start researching your insurance options early in the planning process and maintain open communication with your chosen provider. With the right coverage in place you can enjoy tiny living with complete peace of mind.

Frequently Asked Questions

What type of insurance do tiny homes need?

Tiny home insurance depends on classification. Mobile tiny homes typically need RV insurance if RVIA-certified, while stationary homes on permanent foundations require traditional homeowner’s insurance. Standard homeowner’s policies often don’t cover structures under 400 square feet or homes on wheels, making specialized tiny home insurance necessary for comprehensive protection.

Which companies offer specialized tiny home insurance?

Strategic Insurance, National General, and Foremost Insurance Group are leading providers of specialized tiny home coverage. For mobile tiny homes, Progressive and Good Sam offer comprehensive RV policies. These companies understand tiny home construction and living situations better than traditional insurers who often reject coverage applications.

How does tiny home classification affect insurance costs?

RV-classified tiny homes generally have lower insurance premiums but limited personal property coverage. Traditional home classification provides comprehensive protection but costs more. Mobile homes offer evacuation advantages during disasters, potentially reducing premiums, while permanent placement qualifies for standard homeowner’s rates with utility connections.

What documentation is required for tiny home insurance?

You’ll need certified appraisals from tiny home specialists, detailed construction records, material receipts, and custom feature documentation. Building permits, safety inspections, electrical certifications, and code compliance verification are essential. Current safety certifications must be maintained, as expired documentation can void coverage during claims.

Do tiny homes need to meet building codes for insurance?

Yes, most insurers require tiny homes to comply with local building codes and zoning regulations. This includes proper permits, safety standards, electrical code compliance, and plumbing inspections. Code violations typically disqualify insurance applications, and insurers verify permits before issuing policies, making current documentation crucial.

What safety features are required for tiny home insurance?

Essential safety features include hardwired smoke and carbon monoxide detectors, fire extinguishers, and residential sprinkler systems for homes over 200 square feet. Regular safety inspections and certifications from licensed professionals are required. Missing or expired safety certifications can void coverage and leave homeowners financially exposed.

How much coverage do tiny homes typically need?

Coverage needs vary significantly from traditional homes. Standard RV policies often provide insufficient personal property protection for tiny home living. Upgrading to replacement cost coverage, increasing liability limits, and ensuring adequate additional living expenses coverage is recommended, as tiny home repairs often take longer than traditional homes.

Can mobile tiny homes be insured for travel between states?

Yes, mobile tiny homes need insurance that accommodates interstate travel, as policies vary by region. RV insurance typically provides this flexibility, while specialized mobile tiny home policies account for varying state regulations. Geographic risk factors and natural disaster exposure in different regions also influence premiums and coverage options.